What Is the Significance of Accounting in Business?

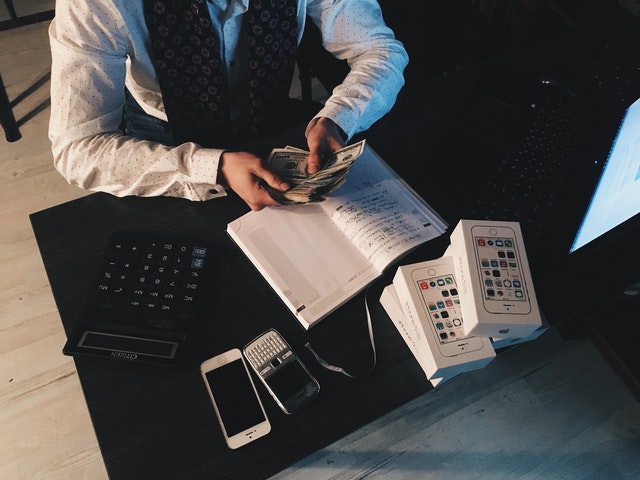

You know you must do it if you don’t want to be subjected to IRS fines and audits. You would be unable to determine the financial health of your company without it. Your business judgments would be based on educated guesses. No surprise here: we’re speaking about accounting.So, how can accounting safeguard your company, measure its health, and assist you in making decisions for your company? In a nutshell, what is the significance of accounting in business?

What is the significance of accounting in business?

Accounting and business are like peanut butter and jelly: they go together, that is to say, that it is impossible to have one without the other. But why is this so?You might wonder why accounting is essential. Without accounting, you would have no way of knowing how much money your company has made. It’s quite easy to lose track and record how much cash you’ve spent. Furthermore, you would have no recollection of how your present profit or loss compares to the prior quarters’ results.Even while you can’t avoid accounting, you can make it more manageable. Visit ato for more details.

Which of your consumers hasn’t paid you yet? What debts haven’t you paid off yet? If you employ accrual accounting, you (should) be able to calculate the precise amount of your accounts receivable and payable.The bottom line is that accounting tells you exactly what has been going on with the financial side of your company. It helps you stay organized so that you can correctly and legally complete your tax return, which we’ll discuss next…

It provides evidence to support your tax return assertions.Many business owners fear the prospect of submitting their small business taxes, especially if they have no clue where to begin. This is where the significance of accounting in business is demonstrated.Getting your financial documents together is the first step in preparing your tax return. You won’t be able to fill out your tax return correctly unless you have certain records (for example, financial statements).

However, since we briefly discussed it above, we’ll move on to the second stage of accounting and tax preparation: the dreaded audit. What happens if you are subjected to an IRS audit? You must demonstrate to them that you have completed your due diligence and that you have the essential accounting information to support your tax return.

Accounting keeps you accountable for your actions.If you have shareholders in your small business, you are aware of the importance of showing rather than telling when it comes to communicating with them. Accounting is responsible for this.It serves as a guide for decision-making.Should you invest in a brand new, top-of-the-line printer for your company’s needs? That is dependent on your financial ability to pay for it.Okay, how about your out-of-pocket expenses? Is there anything you can eliminate from your budget to improve the bottom line of your company? That is dependent on how much money you are spending and on what you are spending it on.